Cash Flow Money Planning

Cash flow money planning is very crucial for personal finance. Do you know where your money flows to?

This is a most important fundamental question towards building your foundation of wealth.

Are you facing these situation frequently ?

- Where my money goes ?

- Am I over spending ?

- How do I get rid of my credit card balance ?

- Why can’t I seem able to save money ?

- Will getting another personal loan help ?

All the essential money plan start with your cash flow statement.

Beware of little expenses, a small leak will sink a great ship. Benjamin Franklin

Understand you cash flow situation

Step 1. Total all your income components

Income can be derived from salary, bonus, self-employed, passive or investment sources. It may include your spouse’s income if you are building the cash flow statement together. If you are a salaried person, be sure to use your take-home pay rather than your gross pay.

Step 2. Estimate you outflow expenses

The best way to do this is to take a three-month average for your total. There are 2 broad categories of your outflow expenses.

- Fixed Expenses, are those costs that generally do not change from month to month which you have little monthly control. For example, rent, mortgage, utilities bills come in every month.

- Discretionary Expenses are those that do change from month to month, such as food, shopping, entertainment. These are the expenses where you make choices and therefore can control.

Also, one of your component of cash outflow is tax. But if you still owed the inland revenue department a substantial balance and need to settle the balance, then you should include tax payment in your cash flow statement.

Step 3. Figure out your surplus or deficit

Once you have added up your monthly income and your monthly expenses, subtract the expense total from the income total to get the difference.

- A positive number indicates you have a Surplus i.e. you’re spending less than you earn. Congratulations

- While a negative number indicates you run into Deficit i.e. your expenses are greater than your income. You need to reduce your expenses.

Improve your cash flow situation

Step 1. Set up your realistic, attainable goals

Write down your financial goals, but do not limit your goals to what you think is possible now. You can also write down other stretched goals and put a time limit on them to help you track progress.

When setting your goals, consider the following factors:

- realistic income

- short term or upcoming financial obligations

- existing debts and assets

- state of your health

- duration of your plan

Step 2. Create your “Balanced” budget

The first baby step towards achieving your financial goals is to draft your “Balanced” budget. A “Balanced” budget is a cash flow statement without Deficit and taking into consideration of savings.

Consider the 2 financial rules of thumb to guide you in your budgeting.

Step 3. Continuous review and adjust your cash flow plan

Well done–you have created a budget. Having follow a budget may confine your spending habit and make your feel slightly uncomfortable initially. It is important to stick to your plan at least for a month and sit down to review and revise your plan if necessary.

Financial rule of thumbs

The 6-Month Emergency Fund Rule

You should have six months’ worth of emergency fund on hand either in saving account, fixed deposit or overdraft account. This is a big help in case an emergency arises in your life.

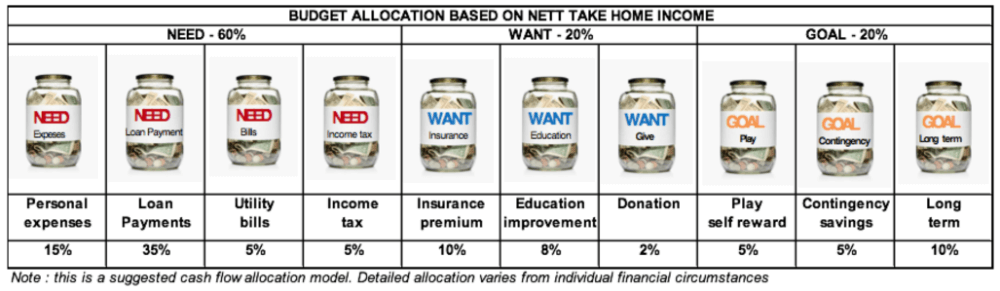

The 60-20-20 Income Allocation Rule

Limit Your Needs to 60

Need are all expenses / payment that would severely impact your quality of life, such as loan payments, utility bills, personal grocery, income tax or prescription medicines is a need.

Allocate Your Wants to 20

Wants are discretionary payments. You can decide the amount and by when. Typical wants are your insurance that protects your income earning capacity, your budget on self improvement training program and not forgetting donation amount.

Reserve Your Goals to 20

This budget define your financial goals. Reward yourself for good job done. Shopping for clothes, beautiful shoes, travel trips, salon haircuts and Italian restaurants are categorized under Play /self reward account. Reserve remaining of your net take home income saving money in your emergency fund and your retirement accounts.

Cash Flow Allocation

Cash Flow Statement

This cash flow statement helps you to track where your incomes and expenses flow to and serve as a good budgeting tool.