Lifestyle 360 Loan Reduction

Do you own property and wish to settle off your loan as quickly as possible ?

We understand that buying a house is one of the most important financial decisions that you will make in your life.

LIFESTYLE 360 : The Smartest Way to reduce your mortgage loan.

Shorten your loan by 50% of the repayment.

Imagine how much savings on your instalments and interests.

It takes hands to build a house, but only hearts can build a home. Unattributed

Understand Your Loan

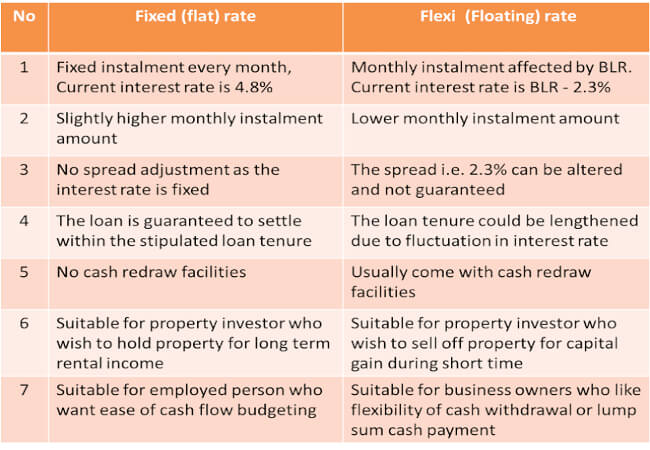

Basically there are 2 types of loan package offered by Financial Institutions, fixed rates & floating rate.

For fixed rate loan, for example hire purchase, credit card and fixed housing rates are considered flat rates category, if your loan are fall into this category raising of interest rate will not affect you.

A floating-interest mortgage would have resulted in a lower monthly payment. Unfortunately, an increase in the general interest rates will usually cause the rates on variable mortgages to increase at the time of the schedule adjustment.

On the other hand, if you have floating-rate loans tied to Base Lending Rate(BLR) or BR(Base rate)+ risk premium ; this mean increase of installment or lengthen loan tenure.

Fixed Vs Flexi Mortgage Loan

We will explore the difference between flat rate (fixed rate) and flexi-rate (floating rate) loans available in the financial market. In what circumstances should you choose a flat rate loan, and when adopting a flexi-rate loan is to your advantage ?

Flat rate (fixed rate) loan

As the name implies, the interest rate of the loan is fixed for the whole loan tenure, what it means is that you just need to pay the same installment amount year after year without worrying on the interest rate fluctuations.

In financial planning terms, paying a fixed installment amount also provide the comfort for cash flow budgeting purpose, while the basic salary increase over time, paying the fixed installment amount allow you better manage your finances.

Flexi rate (floating rate) loan

Flexi (floating) rate is a function of : [Base Rate (BR) + risk premium] or [ Base Lending Rate (BLR) – loan spread] e.g. BR+2% or BLR – 2.3%. .

The loan spread is very much subject to individual borrower credit history and may be altered if the borrower failed to make the loan installment on time.

In the current relatively low interest rate environment, many borrowers are attracted to take up loans with the flexi (floating) rate package due to lower monthly installment.

But how long more will the interest rate remain at all time low ?

Disturbing Truth of Your Loan

Is your loan tenure really fixed ?

Many borrowers normally take loan up to maximum loan tenure in order to pay lower monthly installment.

The general belief is that the loan will be repaid or settled within the stipulated time frame as per in the loan agreement.

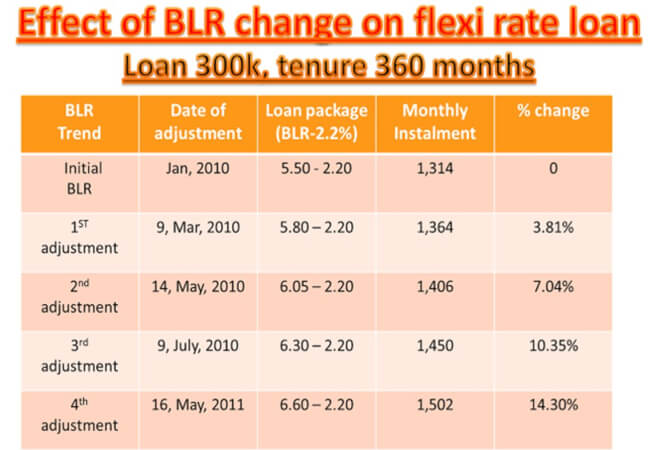

Many are unaware since interest rate are not fixed hence the loan term is never fixed, in fact it fluctuate according to Base Lending Rate (BLR) or Base Rate(BR). With every 1% increase in BLR or BR will cause the loan term to extend for another 5 years longer !

In long term, the average BLR or BR will increase.

Indeed, average BLR for the past 24 years is about 7.2%.

What this means is that there is high possibility the borrowers may need to prepare to pay much higher in loan interest in order to settle the loan.

All in all, an average loan borrower end up paying 100% – 150% more of the loan principal amount.

In simple mathematics, it means borrowers are paying for their house and paying another house for the bank.

As a borrower, how would you feel with all your hard earn money wasted for paying interest ? Take Action and use Lifestyle 360 Loan Reduction strategy to cut your loan tenure !

Interest rate movement from 5.5% to 6.6% over a period of 1 year.

Do you have an increment of 10%-14% per year to cushion the increase of the installment amount ??

Mortgage Calculator

This mortgage loan calculator helps you to simulate change in extra month installments in case of interest increase.