Retirement Planning

Retirement is the beginning of second part of journey of one’s life.

Have a good retirement plan reduce your financial stress when the time comes.

Ever ponder on the following questions :

- How much money do I need to prepare for my retirement ?

- Can I afford to retire early ?

- Are my savings and EPF sufficient to support my retirement ?

- How can I have a meaningful retirement life ?

- What if an illness strikes, am I prepared ?

If any of these questions make sense to you, working on your retirement plan is a good idea.

Either you plan to enjoy your retirement or you will retire from enjoyment. Author Unknown

Understand your retirement

As all of us grow old and retire, we shall need to use our nest egg to support us through old age. If a Malaysian employee retires at 60 years old, and then lives till 85 years old, the retiree would need money to see through another 25 years of post-work years. If a certain life-style is envisaged during retirement, a sum of money is certainly needed that will last at least for as long as the retiree lives.

2 phases of retirement

During the first ten years into retirement, many retirees are still in an active phase. There can much travelling to see the world, play golf and tennis with friends, and much social activities.

The real slowing down starts if ill-health gets in the way or through the natural aging process. Generally, say from mid-seventies and above, the body is more susceptible to diseases. More money will be spent on medicine, doctor and hospital bills to sustain health.

When to plan for retirement ?

For the working adult, the answer has to be right away. In fact there is much advantage to plan for retirement whilst young as it requires less money for the power of compounding to ensure your money grows if you have invested the money wisely.

If you were in your 50’s and you now start to plan for retirement, you will need to be more conservative in your investments because you do not have time to re-earn the money should you lose part of it during a market slump.

Factors affecting your retirement

Health

Because of the advancement in medical technology, humans are living longer than ever. Also, with a balanced diet, exercising and managing the stress in our lives have helped to reduce the chances of hypertension, heart disease, osteoporosis, arthritis, rheumatism and some cancers.

It is quite common people can survive for 20 years or more after retirement.

Finances

As a person approaching retirement, he / she must acquire financial insights and discipline to ensure they have sufficient money to last the rest of their life.

During retirement, there are some expenses that will be reduced and some will increase as they are not apparent before retirement. It is important we take all these expenses into consideration in the retirement planning.

Extra expenses that are not apparent before retirement :

- Higher medical or dental bills

- Higher cost of home utilities

- Higher home upkeep or maintenance

- Higher recreation, travel or eating out

- Contributions or gifts (for grandchildren, charity and etc.)

Expenses that can be reduced :

- Mortgage payment

- Transportation cost

- Children expenses

- Income taxes

- Food

- Clothing

Home

Moving house and retiring from the active workforce at the same time is not a fun thing to do. If moving house is necessary, it should be ideally plan for any move about 5 years before retirement or at least 2 years after retiring.

Interest, hobbies and work

A gradual rather than a sudden adjustment to retirement is the least stressful way to retire. It is therefore a good idea to build new friendships and start new interests, hobbies before we actually retire. We all need to have the sense of purpose in life and retirees need to look at recreational activities to provide this.

Relationships

Majority of Malaysian males rely on work for about 80% of their friendships, and on wives to organize their weekend activities. Thus, retiring from workforce may see a large gap of relationship to be filled. Cultivate new friendships, joining hobby clubs can be a way to fill the relationship gap.

The Big Trip

Retirees should be encouraged to take a trip. However, most people who have just retired are taking their big 2-3 months trip, only to feel deflated and depressed after they return home. It is more advisable to consider a series of smaller holidays and spread over the coming years.

New Business Venture

If starting off or venture into a business is a serious consideration after retirement, it is encouraged to understand the following issues :

- working capital requirement. While start up capital is a one-off payment, working capital present the continuous cash outflow

- business cycle, try to understand whether it is a new introduction, harvesting or maturing cycle.

- the skills and expertise require to run the business successfully

- the business structure, whether a sole proprietorship, partnership or limited company a better option from tax planning perspective ?

EPF enough for Retirement ?

It is estimated that 70-80% of working adult employees are participating in the compulsory savings scheme via the Employee Provident Fund which requires the employee to contribute 11% and the employer 13%.

If the money had not been used by the beneficiary, there should be a substantial sum upon retirement since the recent years EPF has been provided dividend payments around 5-6%.

Nevertheless, these are the questions need to find answer before rest yourself comfortably on the sofa.

- How much is your current EPF savings ?

- How much do you think you have at age 55?

- Do you plan to make any withdrawal ?

- How long do you think your EPF can last?

- Can you guarantee your contribution to EPF?

If your answers are unsure, it is time to seriously look into it.

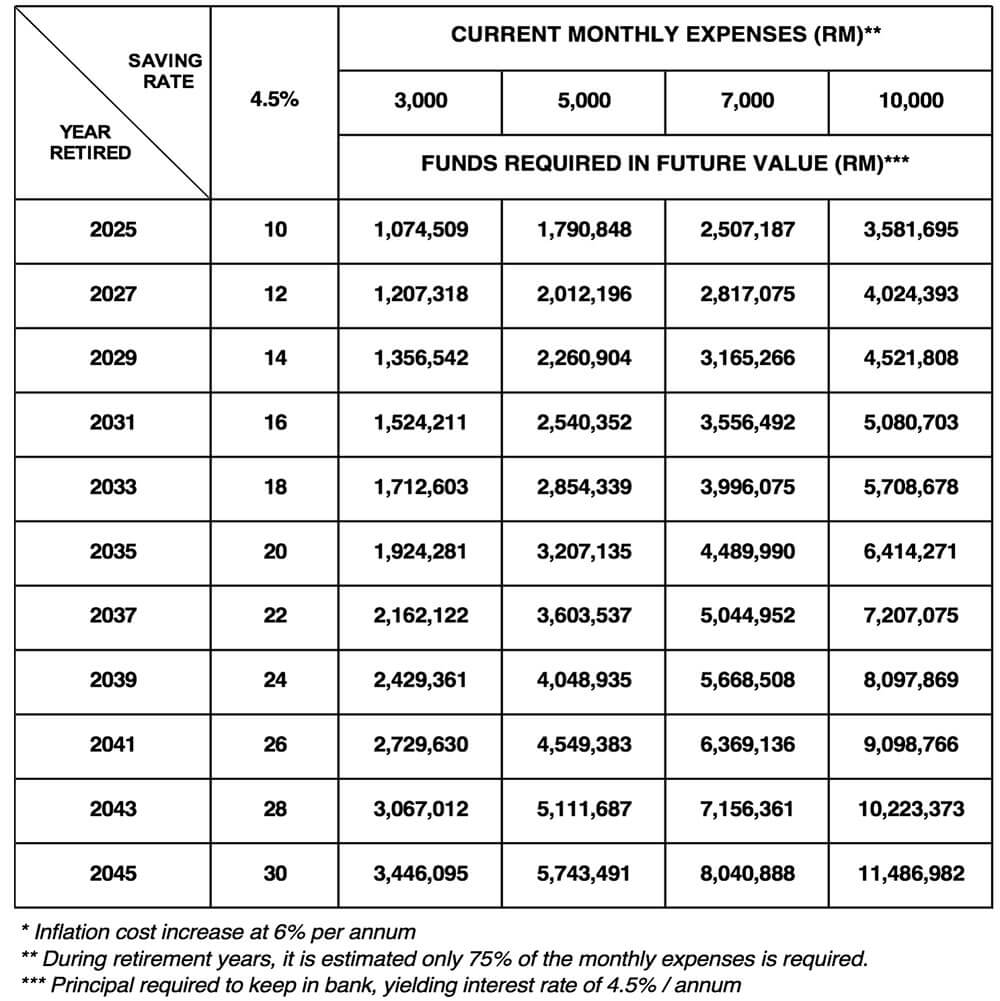

How much is needed for your retirement ?

Retirement Calculator

This retirement calculator helps you to calculate the retirement figures to sustain your lifestyle.